Technology Upgrade Guide

Stay updated with critical dates, action items and FAQs in preparation of our Technology Upgrade

Kohler Credit Union works hard to make your banking experience exceptional and convenient. In order to support these goals, and to continue to provide progressive banking solutions, we are excited to embark on a technology upgrade, including the reissuance of debit cards.

As we prepare for the upgrade process, there are action items and a few changes you need to be made aware of including a brief period of disruption in service and account access.

Please carefully review the information below to understand how the technology upgrade will impact you. This information has also been mailed to all member households.

Technology Upgrade Dates

Friday, April 28 (starting at 5:00pm) – Monday, May 1

What to Expect During the Upgrade Process

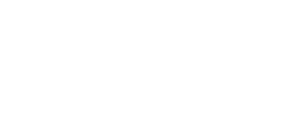

Service Availability Chart

Due to the substantial process involved with the technology upgrade, a brief disruption in service and account access is required. Please review the chart below to familiarize yourself with service availability.

1 Services will gradually become available on Monday as we work through the final stages of the upgrade.

2 Mobile deposit will be unavailable after 4:00pm on Friday, April 28 and through the upgrade process.

3 You will be unable to access online bill pay during the upgrade process. Payments that you scheduled before the upgrade, including recurring/automatic payments and external transfers, will process as planned.

4 The contact center will be available on Saturday, April 29 from 9:00am – 12:00pm, closed on Sunday, April 30, and available Monday, May 1 from 8:00am – 7:00pm. While we are happy to answer member questions about the upgrade, our abilities to access your account information will be very limited during the upgrade. We will be unable to conduct transactions for you, provide you with any account specifics, or perform maintenance or changes.

5 ATMs will continue to dispense cash, but other ATM functions will be limited in the weeks leading up to and through the upgrade weekend.

How to Prepare for the Upgrade Weekend

Verify Your Contact Information

Please ensure your mailing address, email address and phone number are correct so you don’t miss important notices about the technology upgrade. Login to digital banking to review or update your contact information. You can also reach us via secure chat.

Activate Your New Debit Card on May 1st

Debit card holders be on the lookout for a new VISA debit card in your mailbox generally between April 10 – 25, and be prepared to activate it, and set your PIN, starting Monday, May 1.

- If you don’t receive your new VISA debit card by April 26, contact us through secure chat, secure messaging within digital banking or call us at 888.528.2595.

- Your current Mastercard debit card and PIN will work through April 30 (including cards with an April expiration date).

- You will have a new debit card number, so you will need to update any services or automated payments/bills/mobile wallets, etc., with the new debit card information.

- Scorecard rewards are being discontinued effective April 30, 2023. You will be able to redeem your Scorecard points through June 30, 2023.

Check Your Account Balances before April 28th

Since you won’t have access to your balances beginning at 5:00pm on Friday, April 28, we recommend checking your account balances ahead of time so you have the most current information for your weekend and can monitor your spending.

Schedule New Bill Payments before April 28th

Schedule new online bill payments prior to the upgrade process due to digital banking not being accessible. (Payments that you scheduled before the upgrade, including recurring/automatic payments and external transfers, will process as planned.)

Extended Branch Hours

To help our members prepare and transition through the upgrade,

we are providing extended hours.

- Wednesday, April 26 and Thursday, April 27

Our stand alone and Meijer branches will remain open until 7:00pm. - Monday, May 1 through Friday, May 5

Our contact center will be available until 7:00 pm through secure chat at kohlercu.com, secure messaging within digital banking or calling 888.528.2595. - Saturday, May 6 and Sunday, May 7

- On Saturday, our contact center will be available until 1:00pm via secure chat at kohlercu.com or calling 888.528.2595.

- On Sunday, member service representatives will be available via secure chat at kohlercu.com from 8:00am – 1:00pm.

What to Expect After the Technology Upgrade

What Will Stay the Same?

- Credit Cards will function normally, no need for replacements.

- Automatic Payments (ACH) Direct Deposit, Scheduled Transfers will continue to post with no action required.

- Checks will function, no need to reorder.

- KCU Routing Number will remain the same.

What Will Change?

Debit Cards

Please see information under “How to Prepare for the Upgrade Process” for information related to the reissuance of debit cards.

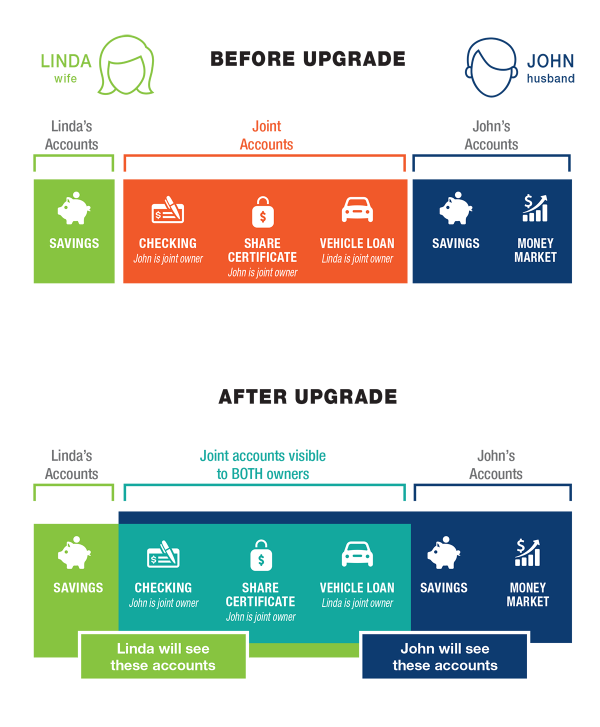

Viewing Your Accounts Within Digital Banking

- Personal Accounts: Usernames and passwords for the majority of our members will not change. We will directly notify those members who will need to reestablish their login information.

For members that have multiple accounts, or are a joint owner on an account(s), and are currently logging into each account separately, you will now see ALL the accounts that are associated with your Social Security number (SSN) with a single login. - Business/Trust Accounts: Business/trust accounts using an EIN will continue to be separated from personal accounts and will have a separate login for digital banking.

For business/trust accounts using a SSN, you will now see them, along with all other accounts that are associated with your SSN, with a single login. - All Accounts: After the upgrade, you can modify which accounts you’d like to see or hide, or establish account nicknames, by going to “Settings”/”Account Preferences”.

You will also need to reestablish any account alerts that you have created by going to “Settings”/”Alerts”. View our digital banking tutorials to learn more.

Viewing Your Accounts Within Digital Banking

Frequently Asked Questions (FAQs)

General FAQ's

The upgrade will begin at 5:00pm on Friday, April 28 and progress through the weekend and into Monday, May 1. We anticipate that services will be available on Tuesday, May 2, with some services gradually becoming available Monday afternoon as we work through the final stages of the upgrade. Please review the Availability Chart for details on the timing and the operations that will be impacted.

Due to the complexity of the upgrade, there will be service disruptions impacting most of our operations starting at 5:00pm, Friday, April 28 through Monday, May 1. Please review the Availability Chart for details on the timing and the operations that will be impacted.

Direct deposits, including pay checks, and automatic/recurring withdrawals set up prior to the technology upgrade process will not be impacted and will post as normal.

Yes, you may continue to use your checks. There is no need to reorder.

Deposits placed in the night deposit box after 5:00pm on Friday, April 28, may not be processed until Tuesday, May 2.

The contact center will be available on Saturday, April 29 from 9:00am – 12:00pm and closed on Sunday, April 30.

While we are happy to answer member questions about the upgrade, our abilities to access your account information will be very limited during the transition period. We will be unable to conduct transactions for you, provide you with any account specifics, or perform maintenance or changes. Normal transaction processing is scheduled to resume Tuesday, May 2.

We have worked diligently for many months to prepare for the upgrade, and in the process, no account information was changed. Your data has been verified and reviewed to ensure accuracy.

Yes, our routing number, 275978417, will remain the same.

Yes, our website will be accessible during the upgrade process, but access to digital banking will be unavailable. Please review the Availability Chart for details on the timing and the operations that will be impacted.

The technology upgrade is an investment in the future of your credit union so we can better serve you. It will allow us to improve our member experience, offer enhanced products and services, and provide innovations in the future.

Besides physically implementing the upgraded technology, we need time to ensure all systems are working properly before coming back online.

Yes, Call KCU will be unavailable during the upgrade process. Please review the Availability Chart for details on the timing and the operations that will be impacted.

Your PIN will default to the last 4 digits of your SSN. The first time you access Call KCU after the upgrade you will be prompted to change it.

Yes, the function of Call KCU will remain the same, but there are new features.

- You will now be asked to enter your full SSN in addition to your PIN to access the system.

- Once you are in the system, you will now be presented with ALL the accounts associated with your SSN when selecting an account type. For example, when you select “savings”, you will be presented with ALL the savings accounts associated with your SSN. You will then select which savings account you would like to access based on the last 4 digits of the account. You can find the last 4 digits of your accounts on your monthly statements.

Debit Card FAQ's

You can activate your new VISA debit card and set your PIN by calling 800.631.3197.

Yes, you can use your current Mastercard debit card for purchases/payments through April 30 (including cards with an April expiration date). You will need to activate and use your new VISA debit card starting Monday, May 1.

Yes, current Mastercard debit card holders will be receiving a new VISA debit card in your mailbox generally between April 10 – 25. You can activate it and set your new PIN starting Monday, May 1. Your current Mastercard debit card and PIN will work through April 30 (including cards with an April expiration date).

If you don’t receive your new VISA debit card by April 26, contact us through secure chat from kohlercu.com, secure messaging within digital banking or call us at 888.528.2595.

You can use your digital wallet (i.e., PayPal, Venmo, Apple Pay, etc.) during the upgrade process ONLY IF your digital wallet is linked to your KCU debit card. You will then need to activate your new debit card on Monday, May 1, and enter your new card number into your wallet.

If your digital wallet is linked to your account number (checking or savings), you WILL NOT be able to send or receive funds through the wallet due to the upgrade process.

Credit Card FAQ's

Your credit card, including your PIN, will not change.

Yes, your credit card will function normally during the upgrade process.

Digitial Banking FAQ's

Digital banking will be unavailable. Please review the Availability Chart for details on the timing and the operations that will be impacted.

- If you solely have a joint account, yes, you will need to reenroll. This change to requiring unique credentials for every individual provides improved security and personalization.

- If you share your SSN with an organization such as a business or trust, yes, you will need to reenroll.

- If you have both a joint account and an individual account, reenrollment will not be necessary. You will use your credentials from you individual account. Also, you will now be able to see ALL the accounts associated with your Social Security number with a single login.

- If you solely have an individual account, reenrollment will not be necessary. You will use your credentials from your individual account.

- If you are the primary account holder on a joint account, and have established payees, payments and history within online bill pay, your information will carry over during the upgrade. Please allow for 3 – 5 business days AFTER you reenroll in digital banking for your bill payment information to reconnect to your account.

- If you are the joint owner on an account (not the primary), certain digital banking functions, such as bill pay, will revert to default settings and will need to be reestablished in the new system after the upgrade. We suggest you download and make note of your information to use as reference when you reestablish your information.

- If you used bill pay through your individual account, your bill pay settings will remain intact.

- Download your online bill pay information prior to the upgrade by following these steps:

- Click “Payees”

- Click the > next to the Payee you’d like to expand

- Click “View History”

- Click “Print (x2)” and save as PDF

- If you need to reenroll in digital banking, and have established/linked financial tools, recurring transfers and member to member accounts, your information will not carry over during the upgrade.

- Prior to the upgrade, take the following actions:

- Financial Tools - Make note of your personalized categories, budgets and linked external accounts.

- Recurring Transfers – Make note of any recurring transfers you have established in digital banking.

- Member to Member Linked Accounts – Make note of any member accounts you have linked. After the upgrade, you will see ALL the accounts associated with your Social Security number with a single login.

No, the mobile app will be unavailable for use during the upgrade process.

Usernames and passwords for the majority of our members will not change. We will directly notify those members who will need to reestablish their log in information.

No, after the upgrade, your mobile app will continue to work how it does today.

Digital banking and our mobile app will not change. However, review the information under “What Will Change” to understand the changes in viewing your accounts.

Your view will revert to default settings. Additionally, for members that currently have multiple accounts, or are a joint owner on an account(s), and are currently logging into each account separately, you will now see ALL the accounts that are associated with your Social Security number with a single login.

After the upgrade, you can modify which accounts you’d like to see or hide, or establish account nicknames, by going to “Settings”/” Account Preferences”.

Debit card transactions that you make over the upgrade weekend may take a few days to post to your account when the system comes back online.

Yes, your transaction history will still be available in digital banking.

You will not receive digital banking account alerts during the upgrade process. Additionally, after the upgrade, you will need to reestablish the account alerts that you created by going to “Settings”/” Alerts”.

Intuit FAQ's

If you aggregate your Kohler Credit Union account data into other software, such as Quicken, please note that aggregation services from Kohler Credit Union accounts will be interrupted during the technology upgrade process and up to 5 business days afterward. If you need to import any Kohler Credit Union transaction data into your account aggregation software, please do so prior to Friday, April 28, or after the upgrade.

To ensure a smooth transition, visit kohlercu.com/Techupgrade for additional instructions on the actions you need to take prior to the upgrade.

To ensure a smooth transition, review the additional instructions below on the actions you need to take prior to the upgrade.

Please allow 5 business days for everything to populate in your aggregation software. If, after that time, it still has not shown up, we encourage you to disconnect and reconnect your Kohler Credit Union account to your Quicken/QuickBooks account.

Automatic Loan Payments, Transfers and Online Bill Payments FAQ's

Scheduled transfers/payments that were created before the upgrade will process as usual. There is no action needed on your part.

Yes, after the upgrade, you will be able to make your loan payments the same way you do today.

Your online bill payee information will carry over during the upgrade process. there will be no need to reestablish pre- existing online bill payees.

Scheduled online bill payments that were created before the upgrade will process as usual. There is no action needed on your part. Please review the Availability Chart for details on the timing and the operations that will be impacted.

Online bill pay will not be available during the upgrade process.

ATM FAQ's

Yes, members will be able to withdraw cash from ATMs during the upgrade process.

ATM functionality, beyond dispensing cash, will be limited in the weeks leading up to and through the upgrade weekend. We anticipate all services will be available on Tuesday, May 2. We recommend checking your balances before the upgrade on Friday, April 28, then manually track your expenses throughout the weekend.

Loan FAQ's

Yes, you will be able to apply for a loan online at kohlercu.com.

Yes, your ability to apply for a credit card online at kohlercu.com will not be impacted.

Previously scheduled payments, including payments scheduled to post during the upgrade process, will be made as usual, but digital banking will be unavailable during the upgrade process to make any new payments. Please review the Availability Chart for details on the timing and the operations that will be impacted.

Security FAQ's

Yes, our stringent security protocols will remain in place as we navigate the upgrade process.

We will reach out to you ONLY if we are sharing information and expectations about events that are occurring during the technology upgrade weekend. Anyone who contacts you claiming to be with Kohler Credit Union, and asks for your personal information such as account number, digital banking credentials, Social Security number, debit card number or PIN, is not associated with the credit union. Kohler Credit Union will never request you provide us with personal information such as account number, Social Security number, PIN, credit card number, or passwords.

If there is any concern or suspicion with regard to any communication you receive from Kohler Credit Union contact us immediately at memberservice@kohlercu.com, Secure Chat on kohlercu.com, secure messaging within digital banking or 888.528.2595.