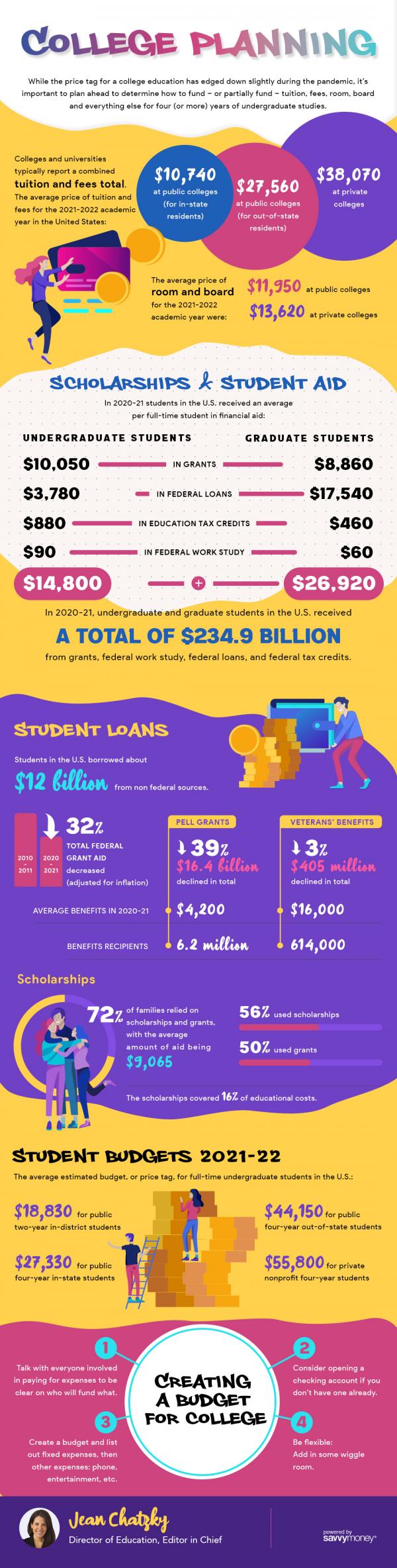

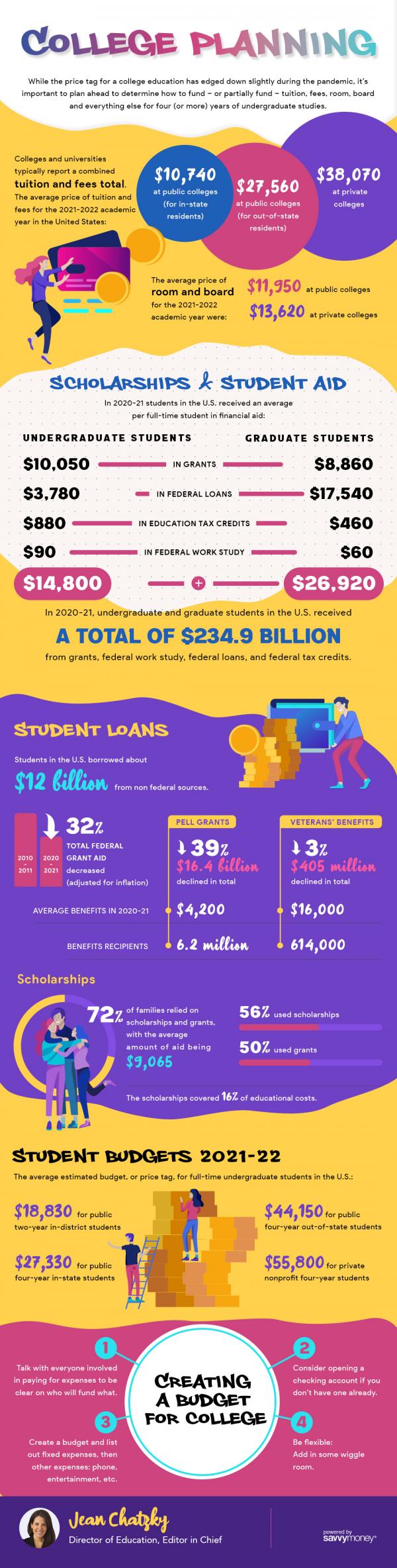

College Planning

While the price tag for a college education has edged down slightly during the pandemic, it’s important to plan ahead to determine how to fun – or partially fun – tuition, fees, room, board and everything else for four (or more) years of undergraduate studies.

College and universities typically report a combined tuition and fees total. The average price of tuition and fees for the 2021-2022 academic year in the United States”

The average price of room and board for the 2021 – 2022 academic year were:

Scholarships & Student Aid

In 2020 -21 students received an average per full-time student in financial aid:

|

|

Undergraduate Student |

Graduate Student |

|

In Grants |

$10,050 |

$8,860 |

|

In Federal Loans |

$3,780 |

$17,540 |

|

In Educational Tax Credits |

$880 |

$460 |

|

In Federal Work Study |

$90 |

$60 |

|

Total |

$14,800 |

$26,920 |

In 2020-21, undergraduate and graduate students in the U.S. received a total of $234.9 billion from grants, federal work study, federal loans, and federal tax credits.

Student Loans

Students in the U.S. borrowed about $12 billion from nonfederal sources. 2010-2011 compared 2020-2021 total federal grant aid decreased by 32%. (adjusted for inflation)

Scholarships

Student Budget 2021-22

The average estimate budget or price tag, for full-time undergraduate students in the U.S.:

Create a Budget for College

Membership eligibility is a requirement for account approval. Please click here to see membership eligibility criteria before applying.

By clicking "continue", you will be leaving kohlercu.com and will be re-directed to a website that is not managed by Kohler Credit Union. Kohler Credit Union is not liable for any content, products, services, or advertising on the linked website and does not endorse any of the products, information or recommendations provided. The website’s privacy policy may differ than that of Kohler Credit Union and may not be as secure. Please visit the linked website's privacy policy for more information.