Common Scam Prevention Tips

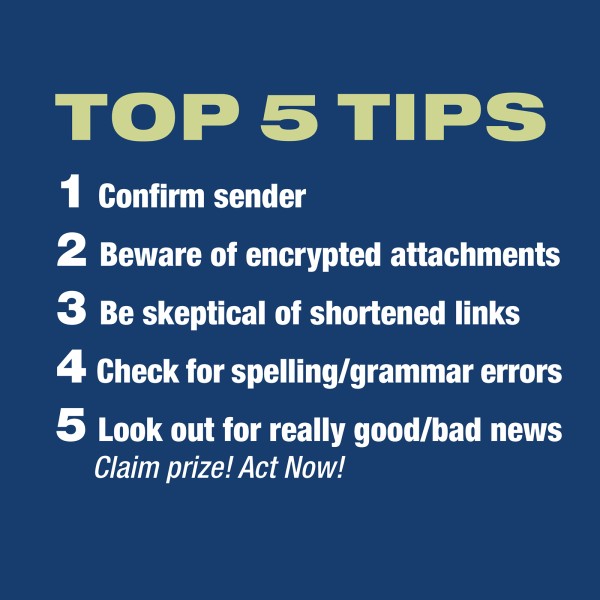

Emails

Start by checking the sender’s email address; legitimate organizations use official domain names, so be cautious if it appears unusual or contains misspellings. Pay attention to the email’s tone and grammar; scammers often use urgency, fear, or overly formal language to exploit recipients. Be careful with unexpected attachments as they may contain malware. Never send personal or financial information in an email and keep your anti-virus software and operating system up to date.

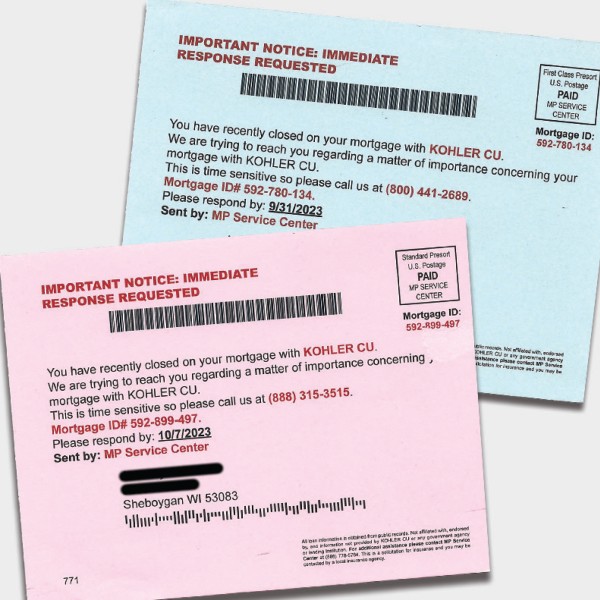

Direct Mail

Look for official logos and contact information, and verify the legitimacy of the sender by cross-referencing with known and trusted sources. Be cautious of mail that requests urgent action or sensitive information, such as personal or financial details, and scrutinize the

return address for any irregularities. Regularly review your mail for anything that seems out of the ordinary and report suspicious mailings to the appropriate authorities. If you recently got a mortgage or auto loan, you may be targeted by scams as some details become public information.

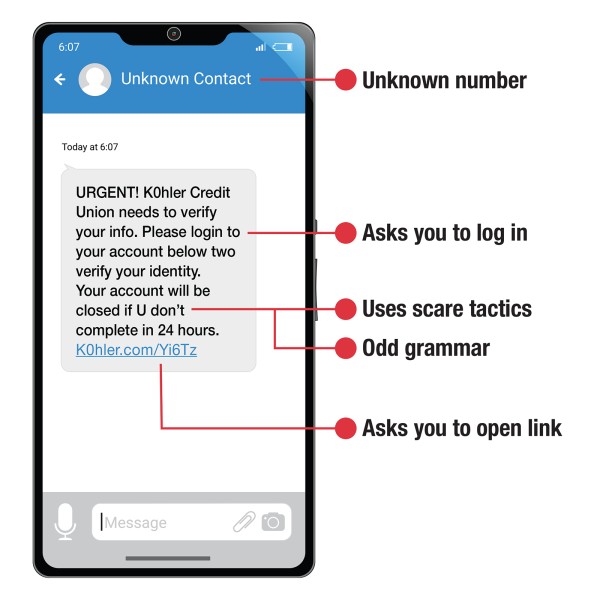

Text Messages

Be cautious of all unsolicited text messages, especially those urging you to take immediate action. Legitimate organizations typically don’t request personal or financial information via text or email. Watch for grammatical errors, as these are common red flags. Review the sender’s phone number and if it appears unfamiliar or unusual, exercise caution. Avoid clicking hyperlinks unless you can verify their legitimacy. If the text triggers a strong emotional response or seems too good to be true, take a moment to investigate further. Trust your instincts and when in doubt, contact the supposed sender through official channels to confirm the message’s authenticity.

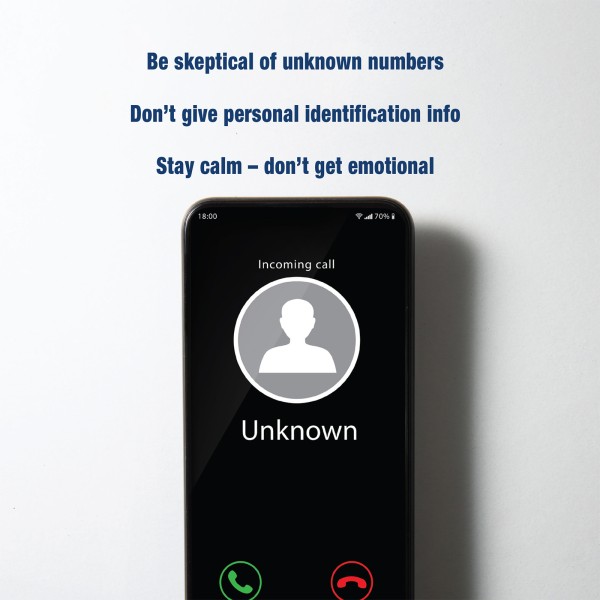

Phone Calls

Be leery of unsolicited calls, particularly those that pressure you to make quick decisions or demand secrecy. Legitimate organizations generally do not ask for immediate action or sensitive information over the phone if they initiated the call. Kohler Credit Union has security procedures in place to verify member identity when you call us directly. Government agencies such as the IRS will make first contact by direct mail. Pay attention to the caller’s tone; scammers often use aggressive tactics or create a sense of fear to manipulate you. Calls from unfamiliar or blocked numbers, payment requests through gift cards, wire transfers or Bitcoin are usually scams. Verify the caller’s identity by asking for official contact information and confirming details independently. Trust your instincts; if something feels off, it probably is. Consider using a call-blocking app to filter potential scam calls.

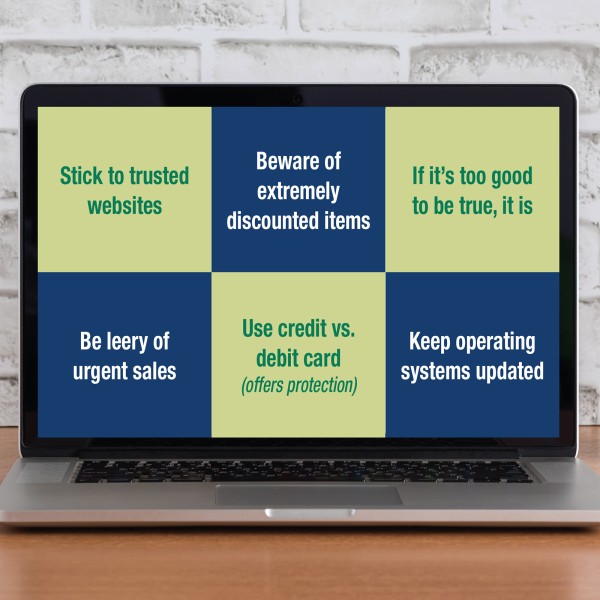

Online Shopping

Be leery of product ads on social media; verify the link is a legitimate and reliable retailer. Thoroughly research the website or online seller by Googling the business name o researching on the Better Business Bureau’s website. Legitimate business websites will have clear contact information, including a physical address and customer service details. Websites that lack secure payment options or ask for unusual payment methods like Bitcoin are suspicious. Check for customer reviews and ratings outside of the company’s website. If the deal seems too good to be true, it probably is, so exercise caution with extremely low and unrealistic prices. Also watch out for websites with a poorly designed layout, spelling errors, or inconsistent branding. Before providing any personal or financial information, ensure the website’s URL starts with “https” to guarantee a secure connection. By being vigilant, you can navigate online shopping with confidence.

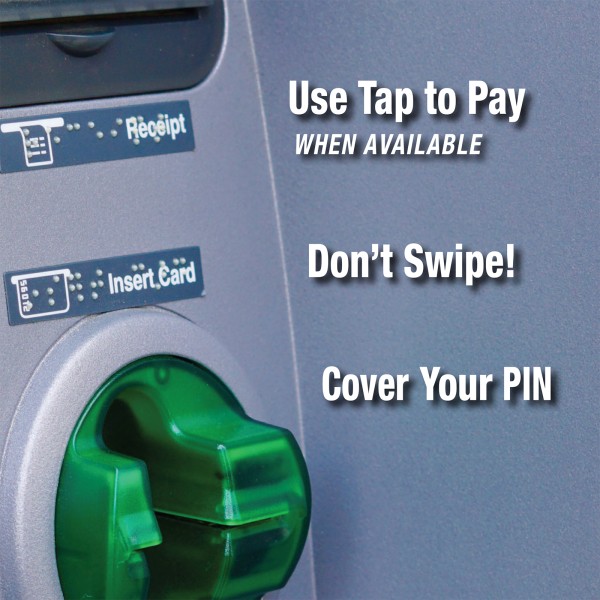

Skimmers

Detecting skimmers, devices designed to illegally capture credit or debit card information, requires a watchful eye when using card readers at ATM’s, gas stations or other retailers. Before inserting your card, inspect the card reader for any unusual attachments, loose parts, or mismatched colors. Give the card reader a slight tug to ensure it is securely attached and not a discreet overlay. Additionally, cover the keypad when entering your PIN to conceal your entry from hidden cameras. Use ‘Tap to Pay’ when available and nsert cards with chips instead of swiping. Regularly monitor your financial statements for unauthorized transactions, as quick detection is key to minimizing damage from skimming.

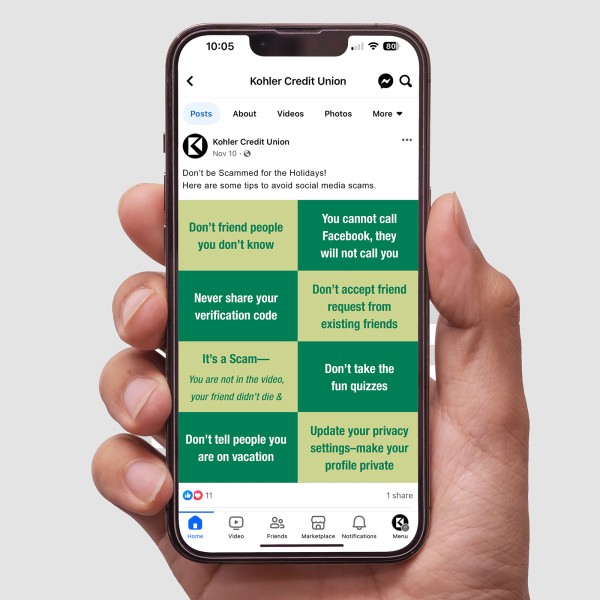

Social Media

Be skeptical of friend requests or messages; especially from unknown profiles or people you are already connected with. Check for the verification badge on official accounts, as reputable individuals and organizations are more likely to have this feature. Watch out for posts or messages that contain suspicious links, request personal information, or encourage urgent action. Messages or posts that contain links including “Is this you?” or “Guess who died?” are the two most common social media scams. Facebook will never call you directly and it is impossible for individuals to call Facebook. Never share your identity verification code. Additionally, be cautious of overly enticing offers or promotions that seem too good to be true. Regularly review your privacy settings and be mindful of the information you share online. Do not participate in quizzes or posts that could provide scammers personal information that may be used in security questions. You also should never post on social media that you are going on vacation as it is an invitation for fraud.