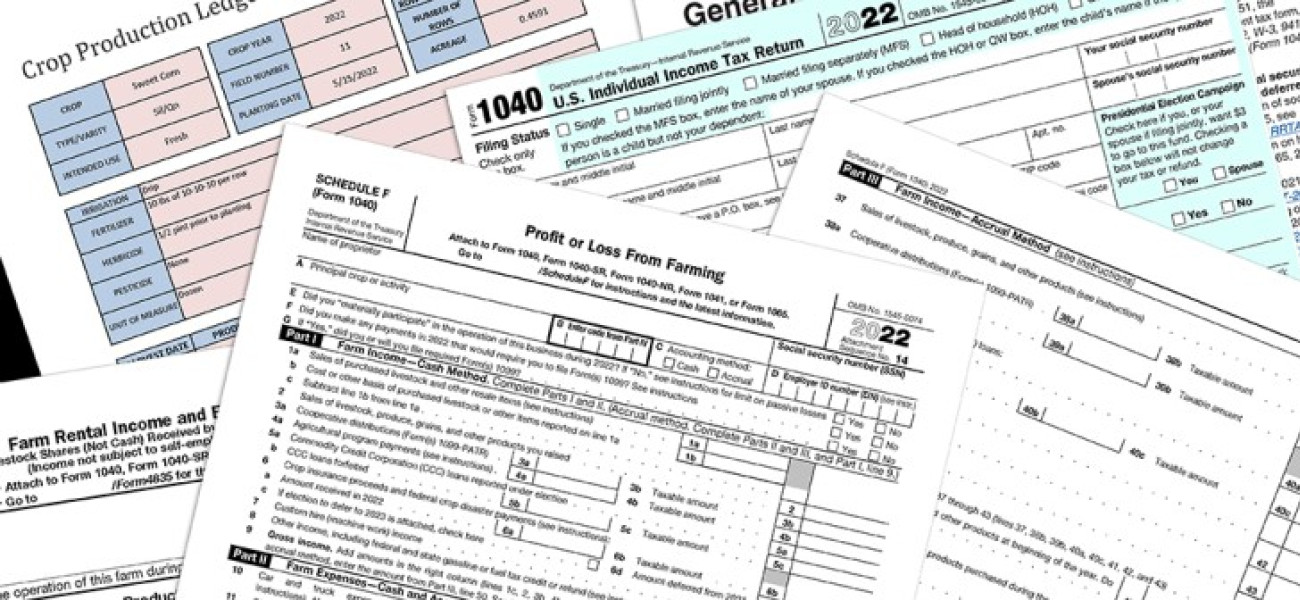

Completing a Return

Filing a tax return is a matter of following the line-by-line instructions that come with your tax form. Each form has its own set of instructions and includes a number of charts and worksheets to help you figure out if you're eligible for credits, deductions, and exemptions.

But before you begin to deal with a tax form, it's smart to understand the ins and outs of your yearly income. The first lesson to learn is that taxes are figured by reducing your income factor by factor.

You start with your gross income and subtract your adjustments to get your adjusted gross income. Then you subtract your exemptions and deductions from that number to find your taxable income.

Gross Income

The term gross income refers to all the taxable income you have in one year. That includes earned income, such as salary and wages, plus sick pay, unemployment wages, strike benefits, and certain fringe benefits. Gross income also includes investment income (or unearned income), which is your capital gains, interest, and dividends. The easiest way to find your gross income is to check the W2 you receive from your employer when it's time to file your taxes.

If you have farm income, rents, retirement and Social Security payments, and gambling earnings, they all might be included in your gross income as well.

Special Considerations

Tips are also taxable income. You have to pay taxes if your employer doesn't withhold on your tips.

Calculating your tips is not an easy task, unless you keep very detailed records of the amounts you receive. The IRS projects the estimate you're likely to receive based on the type of job you have, and expects you to report and pay tax on at least that amount. If you keep careful records and calculate a smaller total than the one the IRS expects, you can dispute the IRS assumptions.

If you lose your job, you'll still be taxed on the unemployment income you receive. At the end of January, you'll receive a Form 1099-G, which shows your unemployment income for the previous year.

Helpful Hints

There are things you don't need to report on your tax return:

- Welfare income

- Veteran's disability benefits

- Worker's compensation benefits

- Supplemental security income (SSI) from Social Security

- Scholarships for tuition

- Child support payments

- Life insurance payouts

- Gifts and inheritances

Knowing Your AGI

Once you've figured out your annual gross income, you'll need to calculate your adjusted gross income, or AGI. You do that by subtracting adjustments, or certain amounts you have spent, from your gross income. The most common adjustments include contributions to IRAs or self-directed retirement plans (like Keoghs or SEPs), half of any self-employment tax you paid, qualified moving expenses, and alimony you've paid.

If your AGI is higher than the limit set by Congress, you won't be allowed to deduct your IRA contribution, and your total exemptions and itemized deductions may be limited.

Exemptions and Deductions

After you calculate your AGI, you can figure your taxable income by subtracting certain exemptions and deductions to which you're entitled.

Each exemption is a fixed dollar amount, and typically increases from year to year. Unless your income is more than the government limit, you get one personal exemption as a single taxpayer and two as a married couple. You also get one exemption for each dependent.

You can also subtract the standard deduction—again, a fixed dollar amount—or itemize all of the qualifying payments you've made during the year and subtract that total. Some itemized deductions include home mortgage interest, real estate taxes, and state and local income taxes.

Finding Your Tax Rate

Once you have your total taxable income, the rest is fairly simple. That number is compared to the tax brackets for the year. Depending on where you fall, that's how you'll find the rate for what you need to pay. The U.S. uses a progressive tax rate system. This means that only the section of income that falls into each bracket is taxed at that rate. The income that falls below will be taxed at the lower rate, and so on, until all of your taxable income is accounted for.

Your Refunds and Payments

Your refund or tax payment depends on what you've paid throughout the year versus what you owe in income taxes. Basically, if you paid more than you owe, you'll receive a refund. Otherwise, you'll have to pay whatever the balance is.

If you're getting a refund, you can either get a check from the IRS for the amount you're owed or apply part or all of the refund to your taxes for the coming year.

If, on the other hand, you owe a payment to the IRS, you must pay it by April 15. Otherwise, you will most likely have to pay interest and a late-payment penalty.

If you file a simple return (such as a 1040EZ, or a 1040 with no itemized deductions and with an income below $100,000) and send it in by April 15, the IRS will calculate your refund or payment for you.

If you have any questions while completing your return, there are lots of tools available to help. This list of frequently asked questions from the IRS, instructions and guides included with tax software, and assistance from a tax professional can all provide additional support.

This article has been republished with permission. View the original article: Completing a Return.